Managing Taxes for Other Countries

The new Taxation Module feature has been added and is now available.

Creating Tax Rules

To create a new tax rule:

- Go to Company

![]()

- Click Settings

![]()

- Open Taxation

![]()

- Click Create Tax Rule

![]()

Fill in the following:

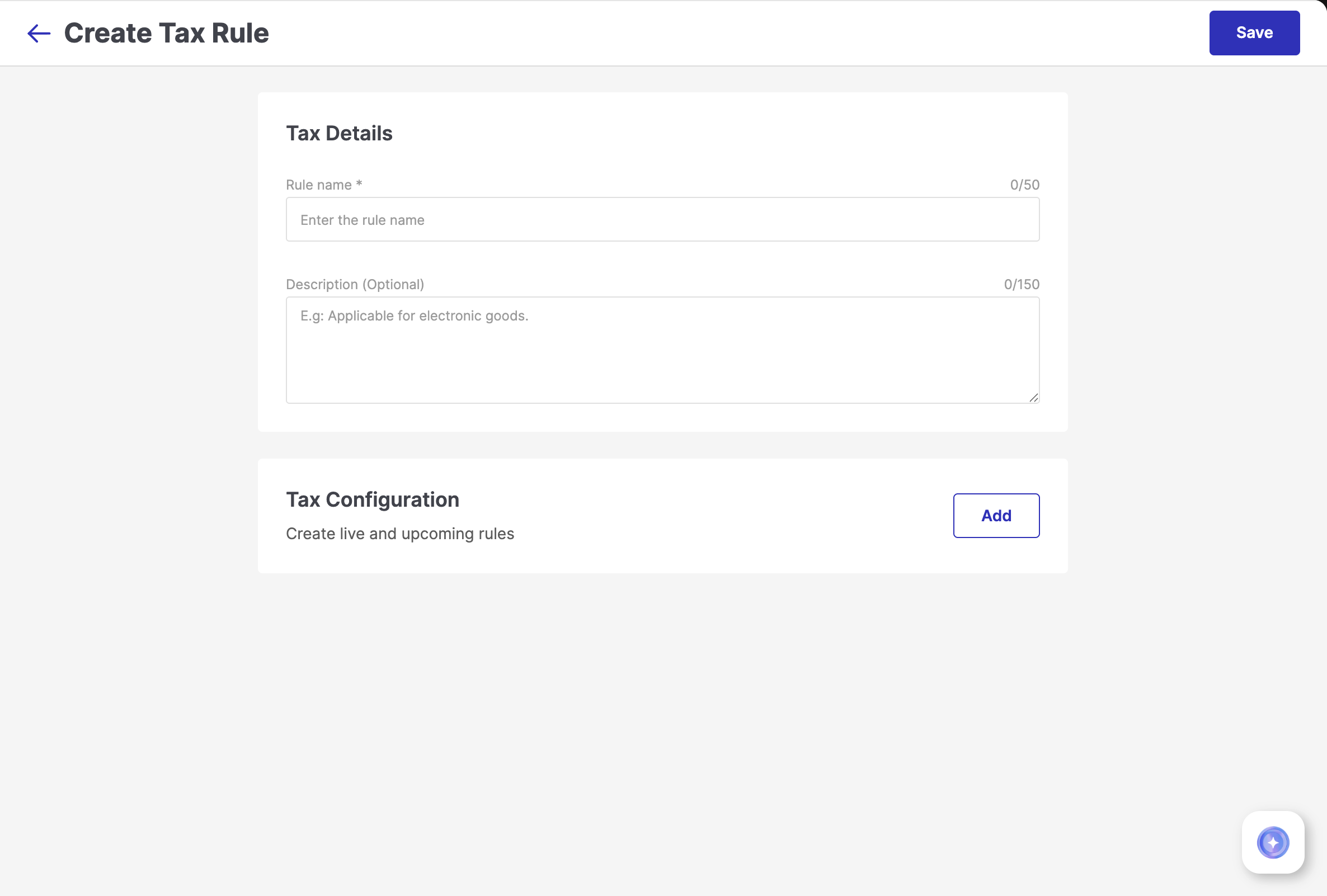

Figure 5: Tax Rule Form - Rule Name: A clear, descriptive rule name to easily identify the tax rule

tipThe tax percentage to the rule name (e.g., “Standard VAT - 5%”) for easier identification.

Description (Optional): Add any internal notes or references for context

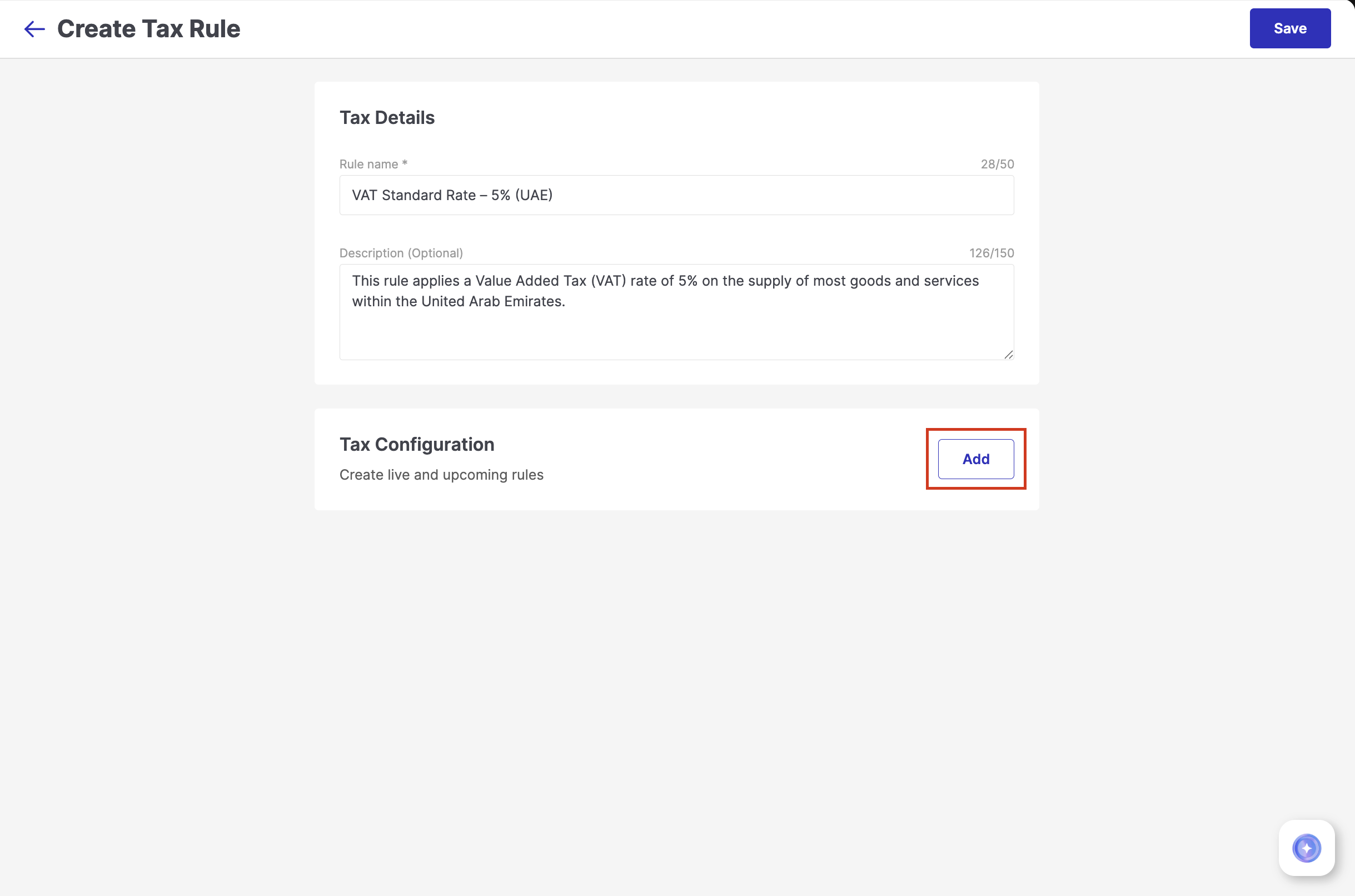

In the Tax Configuration section, Click on Add

Figure 6: Clicking Add - Tax Name: Enter your country’s standard tax name or label. This will appear on invoices, labels, and other related documents and screens.

- Tax Percentage: Specify the applicable tax rate for the rule.

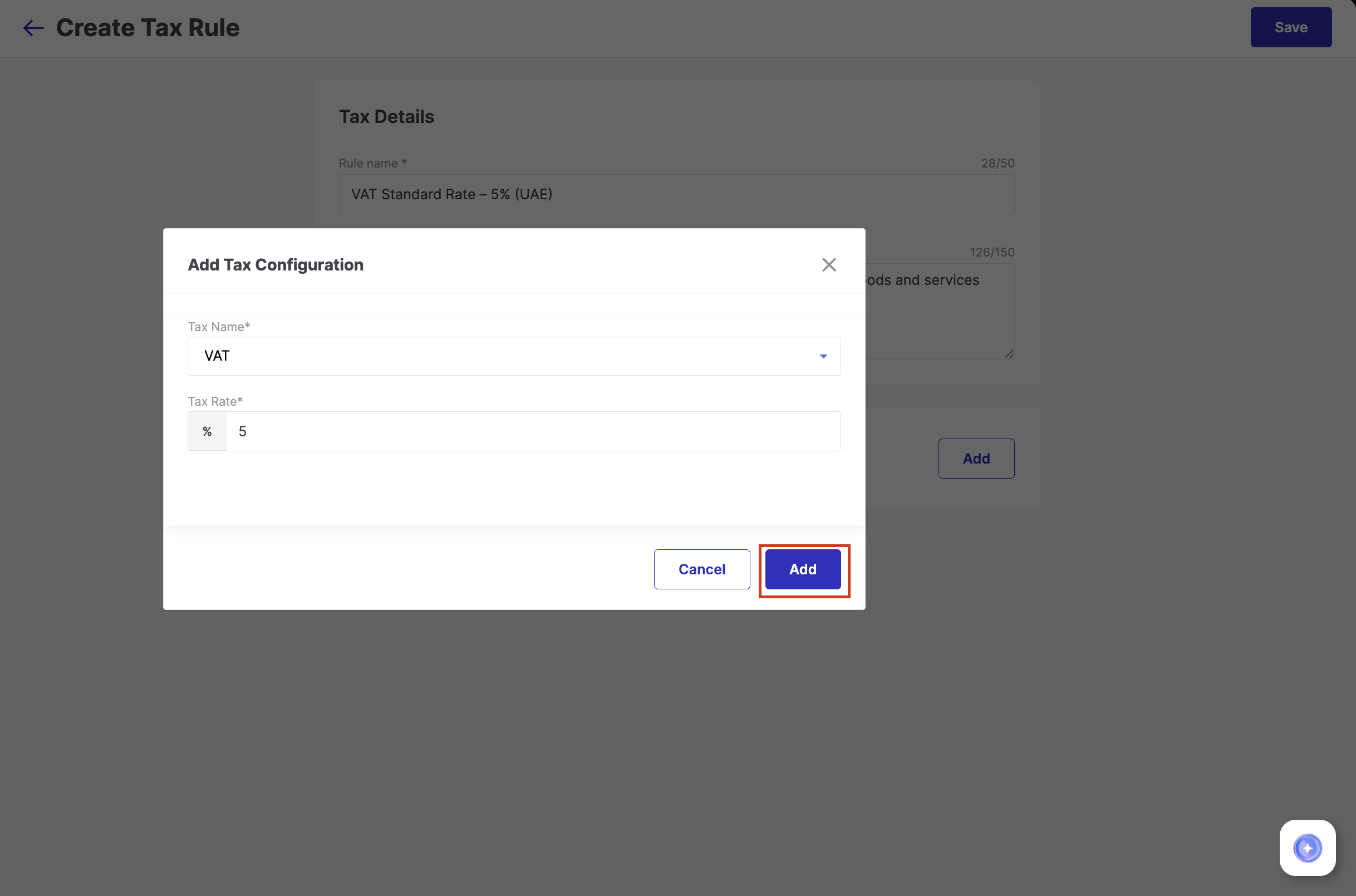

Figure 7: Configuring Tax Click Add to include this tax configuration in your rule, then click Save Rule to finalize and save your tax rule.

Defining Upcoming Tax Rate

Tax rates can change over time. Fynd Commerce helps you stay prepared by allowing you to set upcoming tax rules in advance.

To schedule a tax change to a tax rule:

- Open the existing tax rule

![]()

- In the Tax Configuration section, click on Add to schedule a future change

![]()

- Enter the Effective Date, the date from which the updated tax configuration should apply

![]()

Enter the new Tax Percentage

(Optional) Add a slab structure if the updated tax rate is price-based (e.g., 5% for items up to ₹1000 and 12% for items above ₹1000).

The system will automatically apply the new tax configuration, including any slabs, from the specified effective date to ensure a smooth transition.

- Once done, click Add and Save to apply changes

Applying Tax Rules to Products

- Go to Products

- Select a product to edit

- In the Product Tax Section, select the Tax Rule from the dropdown

- Click Save to apply changes

Applying Tax on Delivery Charges

Tax on delivery charges is optional and only required if delivery charges are configured.

Steps:

- Go to Application → Configuration → Cart → Delivery Charges

![]()

- Go to Delivery Charges

- Select the appropriate Tax Rule from the dropdown

![]()

SAC Code (as shown in the image) is applicable only for businesses based in India. Companies outside India will not see the SAC Code dropdown.

Tax is applied only if delivery charges are enabled and a tax rule is selected.

Applying Tax on COD Charges

Tax on COD is also optional and applies only if COD charges are configured.

Steps:

- Go to Application → Configuration → Payments → Payment Configuration → Offline Payments

![]()

- Go to Cash on Delivery (COD) and enable it (if not already)

![]()

- Select the appropriate Tax Rule from the dropdown

![]()

Tax will be applied only if COD is enabled and a tax rule is selected.